Category Archives: Public Policy

What the New York Times Misses in its Article About China’s Property Market

The New York Times has published yet another article about China’s real estate market and the proliferation of empty apartmentView full post »

CHINA’S URBAN REVOLUTION: An Interview with British Architect Austin Williams

Image courtesy of Austin Williams Very rare is it to meet a China expat in the architecture and design field who is as an astute observerView full post »

TRT World Interview: CUD Blog’s Ziyou Tian on Hong Kong’s Housing Crisis

China Urban Development readers: I’m very pleased to share with you a recent TV news interview with our very own Ziyou Tian on theView full post »

China’s Overheated Real Estate Market

Photo by ?? ? Since the end of 2015, property values have been heating up throughout China. In over 15 cities, home prices increased overView full post »

Why China’s Cities Must Maintain Ties With the Countryside

Shanghai Street. Photo by Henry Nee This article by Harry den Hartog originally appeared at Sixth Tone. One of the first things thatView full post »

Solving Hong Kong’s Affordable Housing Crisis

Mei Tung Estate – Photograph by Can Pac Swire via Creative Commons Hong Kong’s shortage of affordable housing is becoming anView full post »

Hong Kong’s Wong Chuk Hang: How Long Will it be the “Undiscovered Gem” of HK’s Creative Community?

Existing & Proposed MTR Stations, map by Wikimedia Wong Chuk Hang, one of the most hip “undiscovered” neighborhoods in Hong Kong, isView full post »

Solving Problems Across City Borders: Opportunities and Challenges to Regional Planning in China

Photo by Thomas Depenbusch / Photo edited by Author via CC BY China is known for having a strong central government. In many ways, thisView full post »

Tetris and the Challenge of Curbing Chinese Sprawl

While Chinese cities are growing at an unprecedented pace, much of this growth isn’t what most city planners would consider “smart” —View full post »

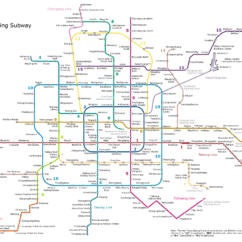

Are Chinese Subway Systems the New American Interstate?

Beijing Subway Map It is virtually impossible not to marvel at China’s new subway systems after spending some time in a city like BeijingView full post »

Q&A With Author of “The People’s Republic of Chemicals”

Nothing threatens the stability of China’s economic miracle more than the hazardous levels of pollution generated by rapidView full post »

5 Questions for Shaun Rein, Author of “The End of Copycat China”

More can happen in two years in a developing country like China than can happen in a decade or more in developed countries. And given thisView full post »