Category Archives: Transportation

How China’s ‘Mall Mania’ Destroys Local Communities

Photo by Adam Mayer This article by Harry den Hartog originally appeared at Sixth Tone. As early as 2002, the Dutch architect Rem KoolhaasView full post »

SUPERDENSITY: An Interview with HASSELL Principal David Tickle

Image courtesy of HASSELL On my Twitter feed I recently came across a post about a new urban development concept calledView full post »

Cycling in Hong Kong: Mission Impossible?

Conceptual Rendering of the Hong Kong “HarbourLoop” Proposal by Lead 8. Image Courtesy of Lead 8 Hong Kong Limited. FromView full post »

Hong Kong’s Wong Chuk Hang: How Long Will it be the “Undiscovered Gem” of HK’s Creative Community?

Existing & Proposed MTR Stations, map by Wikimedia Wong Chuk Hang, one of the most hip “undiscovered” neighborhoods in Hong Kong, isView full post »

Solving Problems Across City Borders: Opportunities and Challenges to Regional Planning in China

Photo by Thomas Depenbusch / Photo edited by Author via CC BY China is known for having a strong central government. In many ways, thisView full post »

Tetris and the Challenge of Curbing Chinese Sprawl

While Chinese cities are growing at an unprecedented pace, much of this growth isn’t what most city planners would consider “smart” —View full post »

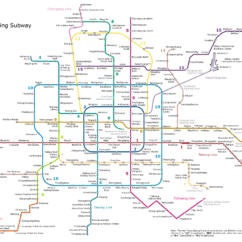

Are Chinese Subway Systems the New American Interstate?

Beijing Subway Map It is virtually impossible not to marvel at China’s new subway systems after spending some time in a city like BeijingView full post »

China In Africa: An Interview With Go West Project

A local looks up at the new African Union Headquarters in Addis Ababa, Ethiopia. The complex was funded entirely by Chinese money. PhotoView full post »

MTR Island Line Extension Set to Change Hong Kong’s Western District

Blue Dot = Current Western Extent of MTR Hong Kong Island Line (Sheung Wan) Red Dot = Terminus of Island Line Western Extension ToView full post »

Guangzhou’s New Central Business District: Zhujiang New Town

Guangzhou’s New CBD (highlighted in red) sits north of the Pearl River and east of the Old City in what not long ago was agriculturalView full post »

Speculation: China’s Proposed Eco-Cities

A piece I wrote about China’s proposed eco-cities appeared recently in the inaugural issue of Dwell Asia magazine. The articleView full post »

High-Speed Train Derails in Zhejiang Province

In a gigantic blow to the credibility and safety of China’s high-speed rail network, a train traveling from Zhejiang’sView full post »