Category Archives: Infrastructure

CHINA’S URBAN REVOLUTION: An Interview with British Architect Austin Williams

Image courtesy of Austin Williams Very rare is it to meet a China expat in the architecture and design field who is as an astute observerView full post »

TRT World Interview: CUD Blog’s Ziyou Tian on Hong Kong’s Housing Crisis

China Urban Development readers: I’m very pleased to share with you a recent TV news interview with our very own Ziyou Tian on theView full post »

China’s Overheated Real Estate Market

Photo by 发课 吴 Since the end of 2015, property values have been heating up throughout China. In over 15 cities, home prices increased overView full post »

Cycling in Hong Kong: Mission Impossible?

Conceptual Rendering of the Hong Kong “HarbourLoop” Proposal by Lead 8. Image Courtesy of Lead 8 Hong Kong Limited. FromView full post »

Hong Kong’s Wong Chuk Hang: How Long Will it be the “Undiscovered Gem” of HK’s Creative Community?

Existing & Proposed MTR Stations, map by Wikimedia Wong Chuk Hang, one of the most hip “undiscovered” neighborhoods in Hong Kong, isView full post »

China Regional Urbanization Trends: 2014 Edition

The Economist Intelligence Unit (EIU) shared with us their new study on “China’s Urban Dreams 2014” – an update onView full post »

China In Africa: An Interview With Go West Project

A local looks up at the new African Union Headquarters in Addis Ababa, Ethiopia. The complex was funded entirely by Chinese money. PhotoView full post »

The State of Seismic Safety in China

The 7.0-earthquake in Ya’an, Sichuan Province this past April once again brought up the topic of construction quality in China.View full post »

MTR Island Line Extension Set to Change Hong Kong’s Western District

Blue Dot = Current Western Extent of MTR Hong Kong Island Line (Sheung Wan) Red Dot = Terminus of Island Line Western Extension ToView full post »

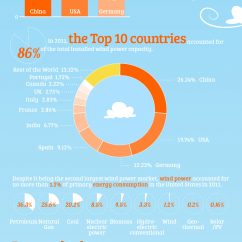

China World’s Largest Wind Energy Market

Infographic Courtesy of Statista Click to share on Facebook (Opens in new window)Click to share on Twitter (Opens in new window)Click toView full post »

Guangzhou’s New Central Business District: Zhujiang New Town

Guangzhou’s New CBD (highlighted in red) sits north of the Pearl River and east of the Old City in what not long ago was agriculturalView full post »

Deindustrializing Beijing: Images from the Decommissioned China National Steel Factory

Beijing’s poor air quality is a well-documented phenomenon, yet what is often not considered is the fact is that the municipalityView full post »